Taxpayer Resources

Taxpayer resources refer to the various tools and services available to individuals and businesses to assist them in understanding and fulfilling their tax obligations. These resources are provided by government agencies, such as the Internal Revenue Service (IRS) in the United States, and aim to educate taxpayers about tax laws, regulations, and filing requirements.

One important taxpayer resource is the official website of the tax authority, which provides a wealth of information and resources. Taxpayers can access forms, instructions, publications, and frequently asked questions to help them navigate the complexities of the tax system. Online tools, such as tax calculators and withholding estimators, are also available to assist taxpayers in determining their tax liability and making accurate payments.

In addition to online resources, taxpayers can seek assistance from dedicated helplines or local tax offices. These channels provide personalized support and guidance to taxpayers, answering their queries and helping them resolve any tax-related issues they may encounter. Taxpayer assistance centers are often equipped to handle face-to-face interactions, enabling taxpayers to receive in-person support for more complex matters.

Furthermore, taxpayer resources extend to educational programs and workshops organized by tax authorities. These initiatives aim to enhance taxpayers' understanding of tax laws and regulations, empowering them to make informed decisions and comply with their tax obligations. Such programs often cover topics like deductions, credits, and record-keeping, equipping taxpayers with the knowledge necessary to navigate the tax landscape successfully.

Overall, taxpayer resources play a crucial role in ensuring that individuals and businesses have access to the necessary information and support to fulfill their tax responsibilities. By making these resources readily available, tax authorities strive to promote compliance, minimize errors, and foster a transparent and efficient tax system.

Track Your Tax Refund in Seconds: Discover the Easy Way to Find Your Money with 'Where's My Refund' have your filing status, refund amount before any fees/advances, and your ssn.

Request Your Tax Transcript Today

and get up to 4 years of your

tax history.

Where's My Refund

Get IRS Transcript

Your IRS Account

Retrieve an IP Pin

Create and or Access your IRS account to get transcripts, make payments, check for data about your most recent tax return, view notices that you may receive from the IRS and much more..

Where you assigned an

Identity Protection PIN (IP PIN)

or did you receive the CP01A

Notice with your new IP PIN, you'll

need to retrieve it or have it

reissued to 'e-file' your return.

Identity Verification

When it comes to taxes, ID.me

plays a crucial role in ensuring a

secure and streamlined process.

ID.me is a trusted digital identity

verification platform that allows

individuals to

prove their identity online, making

it easier for them to access

various tax-related services and

benefits.

The W4 Withholding Calculator is a

valuable tool when it comes to

calculating the appropriate amount

of tax withholding from your

paycheck. This calculator helps you

determine how many allowances

you should claim on your W4 form,

which directly affects the amount

of taxes withheld from your wages.

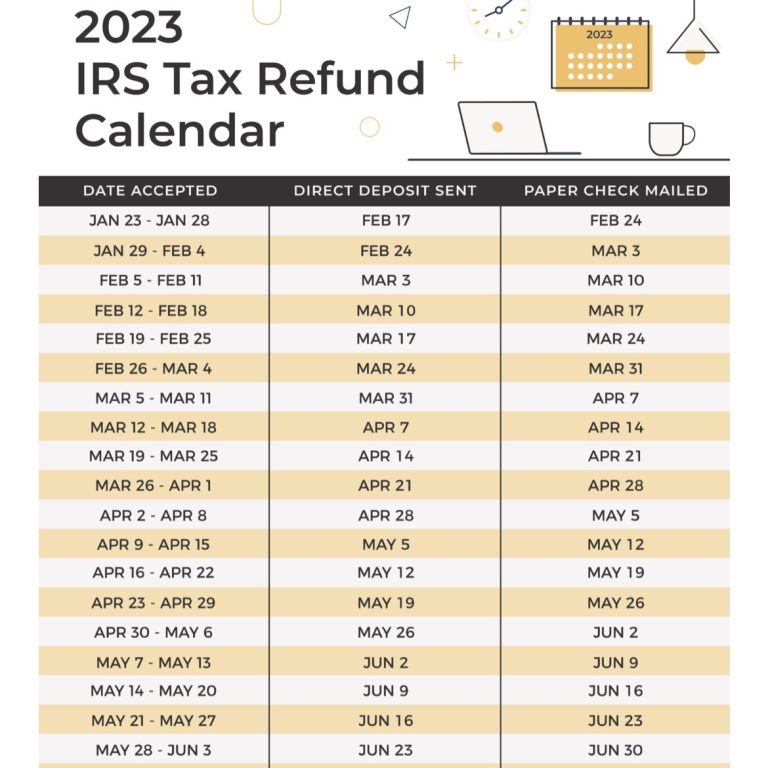

Tax Refund Calendar

W4 Witholding

The IRS tax calendar is an

essential tool for individuals and

businesses to stay organized and

meet their tax obligations. It

provides important dates and

deadlines related to filing

tax returns, making payments, and

other tax-related activities. The IRS

tax calendar serves as a helpful

guide for taxpayers to plan their

finances and fulfill their tax

responsibilities in a timely manner.

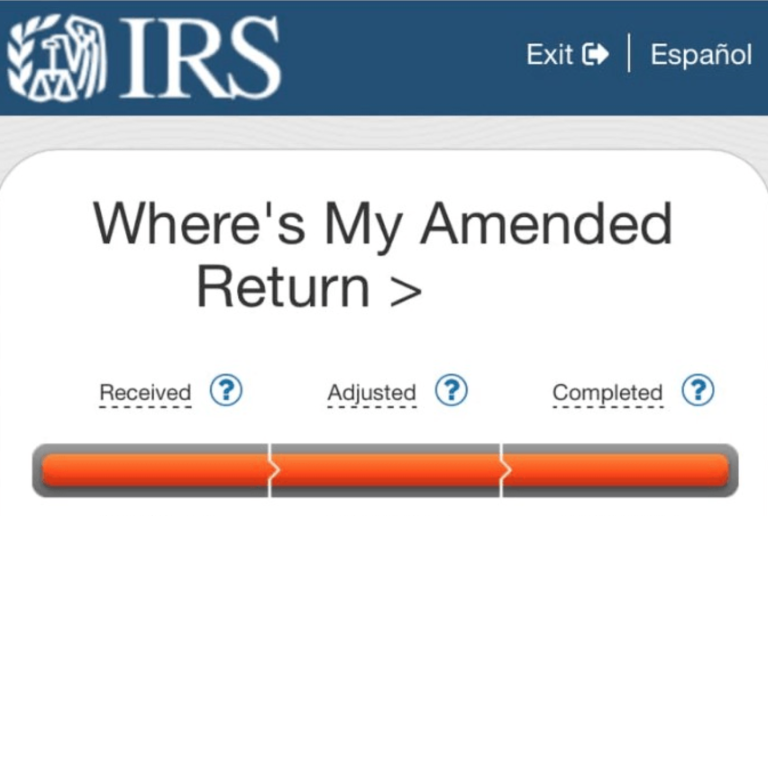

Amended Return

When individuals file an amended tax return, they often wonder about the status and progress of their submission. The Internal Revenue Service (IRS) provides a helpful online tool called "Where's My Amended Return?" to address this query. By entering specific information, such as the taxpayer's Social Security number, date of birth, and ZIP code, this tool allows taxpayers to track the progress of their amended return.

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details and accept the service to view the translations.